Edinburgh sees the UK’s biggest jump in inheritance tax bills – up 315% in a year

Written by

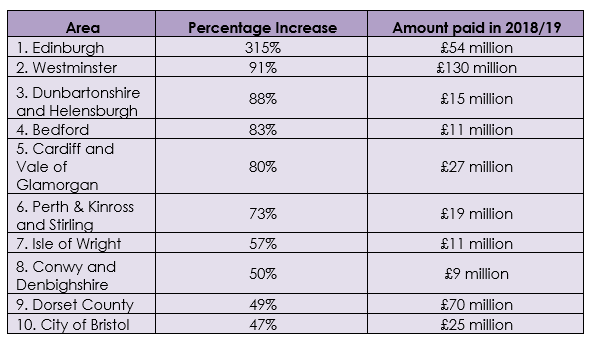

Edinburgh has seen the UK’s biggest jump in inheritance tax (IHT) bills of 134 areas in the last year, with the total IHT bill in the Scottish capital rising 315% to £54 million in the most recent tax year* up from £13 million in the previous 12 months, shows a study by leading private wealth law firm Boodle Hatfield.

Boodle Hatfield says that rising house prices mean that IHT is no longer limited to the very wealthiest families or wealthiest parts of London and the South East. Often the ownership of a family home within an estate can be enough to see the dependents have to pay an IHT bill.

The Scottish capital city of Edinburgh has seen strong house price inflation in recent years, with a 5% rise in property prices in 2019 alone. Boasting the fashionable and historic districts of New Town, the Royal Mile and Broughton, it is also home to Scotland’s most expensive street, Regent’s Terrace, where houses go for an average of £1.75 million.

In addition to the problem of house price inflation, the tax-free allowance on inheritance has also failed to rise in line with inflation, remaining at £325,000 since April 2009. If the inheritance tax free allowance had risen in line with inflation, the threshold would be £445,825.

Boodle Hatfield says that the failure to raise the inheritance tax-free threshold, coupled with rising house prices that drive up the value of the deceased’s estate is why some families are seeing such big rises in their inheritance tax bills.

Although the London borough of Westminster – home to wealthy neighbourhoods including Mayfair, Belgravia and Marylebone – had the second highest percentage rise in inheritance tax** up 150% from £68 million to £130 million, it is the only London location in the Top 5 for increases in IHT.

Third was the Dunbartonshire area, Northwest of Glasgow, with an 88% rise. In 2017/18 to 2018/19, this area saw their inheritance tax bill rise from £8 million to £15 million.

Dunbartonshire is home to a number of leafy and affluent areas within a commutable distance to the Glasgow city centre. One of these, Bearsden, had an average house price of £360,000 in early 2019.

Kyra Motley, Partner at Boodle Hatfield says: “Research showing that areas of Scotland and Wales have growing inheritance tax bills isn’t surprising when you consider rising house prices throughout the UK.”

“Whilst London and the South East continues to dominate in terms of overall IHT paid, it’s clear that the gap between these areas and the remainder of the UK is narrowing.”

Geoffrey Todd, Partner at Boodle Hatfield adds: “The growth in IHT liabilities can also be attributed to the lack of adjustment to the inheritance tax threshold, which has been at the same level for 17 years.”

“The Government has announced that the inheritance tax allowance will remain at the current level until 2026, so we should expect to see this trend continue over the next five years.”

Biggest Risers in Inheritance Tax by Area

Source: HMRC

*2018/19

**Regions where less than £5 million in IHT paid 2017/18

This article was first published in The Times on 29th August 2021.