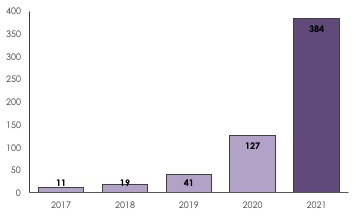

Sharp increase in businesses transferring ownership to employees – 200% rise in the past two years

Written by

There has been a 200% increase in the number of businesses transferring ownership to employees through Employee Ownership Trusts, from 127 in 2019 to 384 in 2021*, says Boodle Hatfield, a leading private wealth law firm.

The number of new Employee Ownership Trusts (EOTs) have jumped 800% from just 41 in 2019.

Employee Ownership Trusts are becoming increasingly popular amongst entrepreneurs looking to exit their business. EOTs enable owners to sell their shares to employees via a trust company, normally for full market value. In doing so, they do not incur income, capital gains or inheritance tax liabilities on the disposal. The model was set up by the Government in 2014 to encourage greater employee ownership of businesses.

EOTs particularly suit owners who want to step away from their business gradually. Typically they will receive a sum of money from the sale of their shares upfront, with the remainder paid from profits from the business over the next few years.

Boodle Hatfield says the benefits of EOTs are considerable. As well as the tax advantages, there is less need for lengthy due diligence processes that would be necessary when selling to an external party. The risk of a deal collapsing due to disagreements between vendor and purchaser is also much reduced. Establishing an EOT is generally a more cost effective way of selling a business, as advisory fees tend to be lower.

Companies that have adopted this ownership model include the home entertainment retailer, Richer Sounds and organic vegetable delivery box, Riverford Organic Farmers and publisher, the Folio Society.

Charlie Hewlett, Senior Associate at Boodle Hatfield says: “The threefold increase in new Employee Ownership Trusts shows owners are increasingly waking up to the advantages of this model.”

“As well as allowing entrepreneurs an advantageous exit, many business owners like the fact that the arrangement benefits employees – the very people who have helped create value in the business. ”

Hugo Brown, Associate at Boodle Hatfield adds: “Employees who own a stake in a company are far more likely to be invested in its long-term success. They are not without their challenges – e.g. the owners may not get all the purchase price up front – but they can be a great option for entrepreneurs who want to attract and retain talent to help their business thrive during the transition and after they step away. Studies have shown businesses operating through Employee Ownership Trusts are associated with high levels of productivity and engagement amongst employees**”

Boodle Hatfield says a common misconception about EOTs is that businesses are typically undervalued, meaning that owners will get less than they would when selling to an external buyer. In fact, the sale price for the shares is their market value.

New Employee Ownership Trusts established jumped 200% to reach five-year high

*HMRC

**Employee Stock Ownership Plan survey, Deloitte

Content from this article was published in Personnel Today on 7th June 2022.