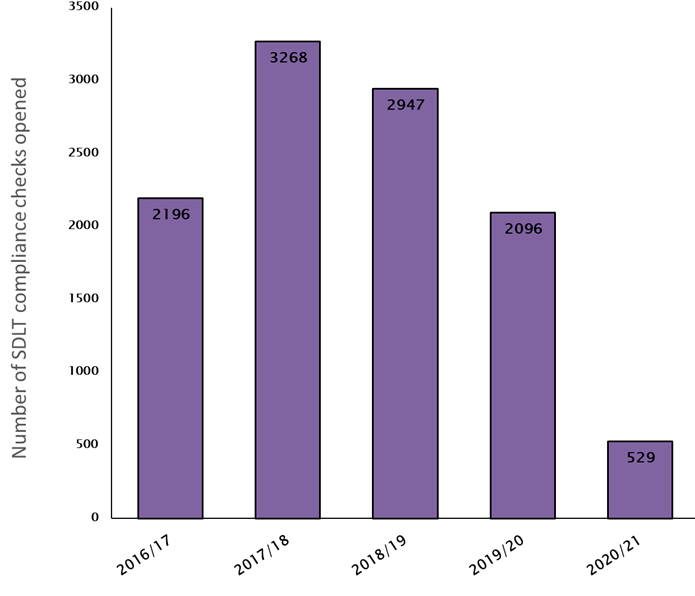

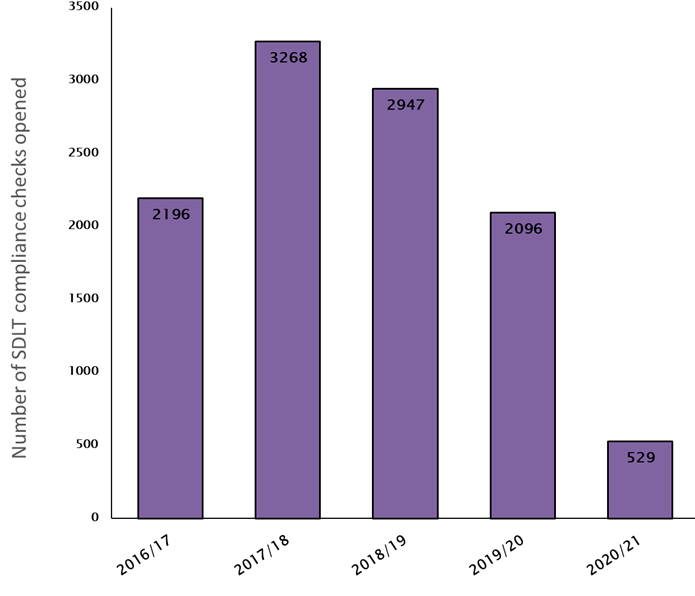

Stamp Duty tax compliance checks fall by 75% in last year due to Covid disruption

Written by

The number of Stamp Duty Land Tax (SDLT) tax investigations by HMRC has fallen by 75% in the last year, from 2,096 in 2019/20 to 529 in 2020/21*, shows research from Boodle Hatfield, a leading private wealth law firm.

The drop in investigations is likely due to HMRC diverting resources away from traditional tax compliance work and towards the administration of the furlough scheme during the pandemic.

Boodle Hatfield says it’s likely HMRC is now starting to examine SDLT returns submitted during the pandemic. As the furlough scheme winds up and HMRC returns to normal working practices, tax investigations are expected to begin to return to pre-pandemic levels soon.

Boodle Hatfield says the applicability of SDLT relief can be subjective. HMRC may challenge claims by property owners who are not trying to defraud the taxpayer but are uncertain of how the rules apply or legitimately believe they are entitled to relief.

Ways in which some property owners may legitimately reduce their SDLT cost on a property purchase include:

- Claiming their property is a mixed-use property to qualify for the lower commercial rate of stamp duty. This can apply if the land use is both residential and commercial.

- Claiming multiple dwellings relief if their property has a granny flat or annexe.

SDLT enquiries may also detect fraud, where individuals deliberately make dishonest or inaccurate disclosures in an attempt to underpay or evade Stamp Duty.

Kyra Motley, Partner at Boodle Hatfield, says “It is an astonishingly sharp drop in SDLT investigations, especially when set against the boom in residential property transactions.”

“It seems unlikely that this drop in investigations means there has been a similarly sharp drop in wrongly claimed SDLT reliefs.”

“HMRC will be keen to make up for the shortfall in investigations over the past year. We would expect them to scale up activity now that lockdown restrictions have ended and all the HMRC teams return to a more normal working environment.”

*Year-end March 31st

SDLT investigations fall to lowest levels in five years

This article was covered in The Property Industry Eye, Mortgage Introducer, eprivateclient and Mortgage Strategy and 12th August 2021.