UK’s Top 100 family businesses grew turnover 13% to £158bn last year – far outstripping FTSE 100

Written by

The UK’s Top 100 family businesses* grew their turnover 13% from £138bn to £158bn in the past year, far outstripping the 0.1% turnover growth of the FTSE 100, shows a new study by Boodle Hatfield, the leading private wealth law firm.

The UK’s Top 100 family businesses* grew their turnover 13% from £138bn to £158bn in the past year, far outstripping the 0.1% turnover growth of the FTSE 100, shows a new study by Boodle Hatfield, the leading private wealth law firm.

Boodle Hatfield says that the UK’s family-owned businesses are now a significant and fast-growing sector of the economy. Often overlooked in favour of listed and private equity-owned businesses, the Top 100 family businesses make a major economic contribution to the UK. They now employ 756,000 people – more than the working-age populations of Manchester and Liverpool combined.

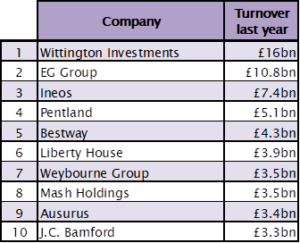

The UK’s Top 10 family businesses by turnover last year

Major family businesses are often in a better position to deliver fast growth than large listed businesses. Family owners frequently find it less necessary to increase the profits of the business year on year as listed businesses are under pressure to do, and instead are keen to invest earnings and potential dividends into growth.

Boodle Hatfield’s study also shows that the Top 100 family businesses paid out just 13% of their profits as dividends to shareholders last year, compared to 67% for FTSE 100 businesses – suggesting a longer-term approach to dividends by family-owned businesses.

Boodle Hatfield explains that another reason why family businesses may be able to deliver faster growth is that family shareholders’ long time horizons make them comfortable with investing in underperforming businesses that may not deliver results immediately. Family shareholders usually see their roles as being custodians of a family business for future generations and are more able to be patient with acquisitions than a listed company CEO.

Hayden Bailey, Partner at Boodle Hatfield, comments: “Britain’s major family businesses are a vitally important part of our economy, delivering strong growth and employing hundreds of thousands of people.”

“Family businesses are uniquely well-positioned as patient, long-term investors in growth. Family shareholders tend to see the business and its earnings in terms of generations, not quarters. Having an outlook that covers decades confers clear advantages in terms of implementing strategy, taking calculated risks on acquisitions and building up vast institutional knowledge.”

“It’s important that the Government recognises the value of family businesses to the UK and ensures that they are allowed to continue to deliver strong growth. Changes that may be made to capital gains tax or inheritance tax could result in that growth stalling. For example, business property relief on IHT is critically important to family businesses and should be preserved.”

Retail the biggest sector for Top 100 family businesses

Boodle Hatfield’s study shows that retail is the biggest industry for groups in the UK’s Top 100 family businesses. Retail makes up 25% of the turnover of the Top 100 – a total of £40bn in the past year.

Major retailers in the Top 100 family businesses include EG Group, owned by brothers Mohsin and Zuber Issa. The group, which recently acquired Asda from Walmart for £6.8bn, also owns a chain of 5,200 petrol stations throughout the UK and Europe. Other major retailers in the Top 100 include:

- Lush, the ethical cosmetics retailer

- High street fashion retailer River Island

- Specsavers, the optical retailer

Major family businesses often more diversified than listed companies

Boodle Hatfield’s study also shows that 24% of the turnover of the UK’s Top 100 family businesses – a total of £38bn last year – is generated by groups diversified across multiple industries. This approach has fallen out of favour among listed businesses in recent decades, but is still common among family-owned groups.

Examples of these diversified groups include:

- Bibby Line – logistics, marine services, plant hire, financial services and convenience stores

- Rigby Group – IT infrastructure, regional airports and luxury hotels

- Bestway Group – grocery wholesale, cement manufacturing, banking and retail pharmacies

The firm says that shareholders of family businesses often seek diversification in this way, especially when a new generation of the family takes control of the group. These younger family members often seek to continue the business’s growth and protect their future incomes by expanding into new sectors. This is more tax-efficient for shareholders than taking money out of the business and diversifying their risk by investing in shares in other companies.

Adds Hayden Bailey: “Entering into new sectors serves three purposes for family businesses – it allows younger shareholders to make their mark on the company, it diversifies their risks and it adds revenue streams that can protect the group in case of a downturn in its core industry.”

* The 100 largest UK-headquartered businesses where at least 50% of the equity is owned by individuals, families or family trusts

This article first appeared in the Daily Express, The i, Yorkshire Post & eprivateclient in December 2020.