Long term residence and its importance for UK inheritance tax (IHT) purposes

Written by

Traditionally, inheritance tax (IHT) treatment was determined by an individual’s domicile status: an individual who was domiciled or deemed domiciled in the UK was subject to IHT on their worldwide estate. On the other hand, an individual who was neither domiciled nor deemed domiciled in the UK was subject to IHT on their UK situated assets (and certain overseas property connected with UK residential property) only.

However, from 6 April 2025, a new regime applies under which domicile is no longer a connecting factor and which instead looks at whether an individual is a “long-term UK resident” in a tax year.

When is someone considered a long-term UK resident?

From 6 April 2025, an individual will be a long-term UK resident if they have been tax resident in the UK for at least 10 out of the previous 20 tax years. Note that the UK tax year runs from 6 April to the following 5 April; and years of residence do not have to be consecutive.

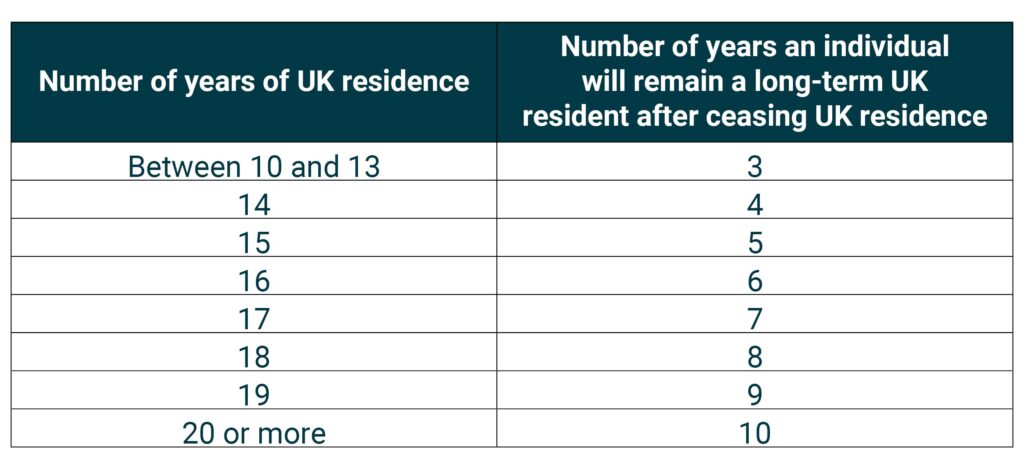

Residence is established in accordance with the statutory residence test (SRT) for all tax years from 6 April 2013 onwards; and, for prior tax years, under the old ‘common law’ test for income tax. If an individual qualified for ‘split year’ treatment under the SRT in any year, this will count as a year of UK residence for these purposes. Once an individual becomes a long-term resident, their long-term residence status continues for a period after they cease UK residence: they will remain a long-term UK resident for a minimum of three and a maximum of 10 years after leaving the UK, depending on the amount of time they were previously UK tax resident. This “tail” applies as set out in the table below:

After 10 consecutive tax years of non-residence, the test is reset. Individuals can therefore resume UK residence in year 11 and they will have a further 10 years until they would become long-term UK resident again.

There are separate rules for those aged under 20 years, who will be long-term UK resident if they have been UK resident for at least 50% of the tax years since their birth.

Transitional rules – individuals who ceased UK residence before 6 April 2025

There are transitional rules for individuals who ceased UK residence before the new rules were introduced on 6 April 2025. Under these rules, individuals who were not domiciled in the UK for general law purposes on 30 October 2024 and who are not resident in the UK in the 2025/26 or any subsequent year will only be a long-term UK resident (and therefore subject to IHT on their worldwide estate) if they have been UK resident (a) for 15 of the previous 20 tax years and (b) in at least one of the three previous tax years.

Therefore, a non-UK domiciled individual who was resident in the UK for (up to) 14 out of the previous 20 years up to and including 2024/25, but who ceased UK residence on 5 April 2025 will not be a long-term UK resident, notwithstanding that they have been UK resident in 10 of the previous 20 years. On the other hand, a non-UK domiciled individual who has been resident in 15 or more of the previous 20 years (and therefore was or would have been deemed domiciled) but who was last resident in the 2024/25 tax year, will be a long-term resident for three years from 6 April 2025 to 5 April 2028.

If they do resume UK residence at any time after 5 April 2025, these transitional rules will not apply and their long-term UK residence status will be determined in accordance with the normal rules described above, i.e. whether they have been UK resident for 10 out of 20 preceding tax years.

Personally held assets

IHT is payable on the value of an individual’s estate on death at a flat rate of 40%. It may also be payable on certain lifetime gifts, including gifts into trust. This is subject to various exemptions and reliefs and every individual has a tax-free personal allowance, which is currently £325,000 (known as the “nil rate band”).

For deaths and chargeable lifetime transfers occurring on or after 6 April 2025, the extent of any charge to IHT will generally depend on where the assets are located and whether the individual is a long-term UK resident.

- If they are a long-term UK resident, they will be subject to IHT on their worldwide property.

- If they are not a long-term UK resident, IHT will only be charged on their UK assets, which for these purposes includes certain non-UK property connected with UK residential property. They will not be subject to IHT on their non-UK assets or on holdings in UK authorised unit trusts or open-ended investment companies.

- Outright lifetime gifts of non-UK property made while they are not a long-term UK resident, will be outside the scope of IHT (assuming the ‘gift with reservation’ rules don’t apply) even if they die within seven years or if they subsequently become a long-term resident. In contrast, however, if they are a long-term UK resident and make a lifetime gift of any of their worldwide property, it could be within the scope of IHT, even if they subsequently cease to be long-term UK resident.

Assets transferred to an individual’s spouse or civil partner either during their lifetime or on death are generally exempt from IHT. However, this relief is limited to the nil rate band if they are a long-term UK resident and their spouse/civil partner is not. In these circumstances, it may be possible for their spouse or civil partner to elect to be treated as a long-term UK resident to obtain the benefit of the unlimited exemption, although their spouse will then acquire this status in relation to their own position going forwards.

Settled property – the relevant property regime

Most trusts are subject to the UK’s “relevant property” regime, which imposes an IHT charge of up to 6% on each 10th anniversary of the trust and on distributions of capital from the trust. These charges do not apply, however, to “excluded property” held in the trust.

Up to 6 April 2025, property held in trust was excluded property if (a) it was situated outside the UK (and it was not connected with UK residential property) and (b) the settlor of the trust was neither domiciled nor deemed domiciled in the UK at the date of settlement. A subsequent change in the settlor’s domicile status did not generally affect the status of the trust property for so long as the property remained in the same trust. This allowed a non-UK domiciled individual to settle non-UK situated assets on to trust before they became deemed domiciled and the assets would remain protected from IHT even if they subsequently became domiciled or deemed domiciled in the UK.

However, from 6 April 2025, the excluded property status of non-UK situated property held in trust will no longer be fixed at the date of settlement, but rather it will depend upon the long-term UK residence status of the settlor at the date of the relevant charge. Therefore if an individual becomes a long-term UK resident, any non-UK assets held in a trust settled by them will become relevant property at that time. Similarly, on an individual ceasing to be a long-term UK resident, non-UK property held in trusts settled by them will cease to be relevant property. This can give rise to an IHT “exit charge” under the relevant property regime some years after a settlor ceases UK residence, which trustees need to be aware of.

There are no exceptions for trusts already settled before the new rules came into effect. For instance, if an individual settled a trust 10 years ago at a time that they were non-UK domiciled and they became long-term UK resident on 6 April 2025, any excluded property in the trust will have become relevant property and fallen within the scope of IHT on that date, and will remain so for as long as the settlor remains a long-term UK resident.

When a settlor dies after 6 April 2025, the IHT status of the trust becomes fixed, dependent upon the long-term UK residence status of the settlor at the date of death. For trusts with settlors who died before 6 April 2025, the existing excluded property rules remain, i.e. excluded property status of non-UK property is dependent upon the domicile status of the settlor at the date of settlement.

Qualifying interests in possession

Where a beneficiary of a trust has a qualifying “interest in possession” (a “QIIP trust”), the trust assets form part of the beneficiary’s estate for IHT purposes and the property is not subject to the relevant property regime. Instead, IHT may be charged on the death of the beneficiary or on the termination of their interest in the trust during their lifetime. Prior to 6 April 2025, non-UK situated property in the QIIP trust would be outside the scope of IHT if the settlor was neither domiciled nor deemed domiciled in the UK when the Trust was set up, regardless of the domicile status of the beneficiary.

In contrast, from 6 April 2025, such property will only be outside the scope of IHT if both the settlor and the QIIP beneficiary are not long-term UK residents on the death of the QIIP beneficiary or the termination of their interest. Where the settlor has died, one looks at their long-term residence status at the date of death (if they died on or after 6 April 2025), or their domicile status at the date of settlement (if they died before 6 April 2025). However, under transitional provisions property that was excluded property and comprised in a QIIP trust immediately before 30 October 2024 will remain excluded property and not be subject to an IHT charge on the death of the QIIP beneficiary or on the termination of their interest so long as it is non-UK situated (and not connected with UK residential property) at the date of the charge.

Settled property – the gift with reservation of benefit rules

If an individual is a long-term UK resident and they benefit or are able to benefit from a trust which they have settled, the trust’s worldwide assets will form part of their estate for IHT purposes on their death, irrespective of their long-term residence status at the date of settlement. This is in addition to the trust property being subject to the relevant property regime discussed above. However, there is an exception to this rule for property that was excluded property held in a settlement immediately before 30 October 2024: this will not be subject to charge under the gift with reservation provisions so long as it is non-UK situated (and not connected with UK residential property) at the date of the charge.

Summary

The change from domicile to the long-term UK residence test as the determining factor for the IHT treatment of foreign property will bring forward the date on which non-UK domiciled individuals moving to the UK will become subject to IHT on their worldwide estates, but it should provide more certainty. However, the shift to a more ‘fluid’ system in respect of foreign property held in trust will require a change of mindset for settlors and trustees and will require active ongoing monitoring of a settlor’s UK residence status, including for a number of years after they leave the UK.