Mansion tax: High-value homes and higher bills

Written by

The Autumn Budget may not have delivered major reform to the taxation of land, but it did include a sting in the tail for owners of high-value residential properties in the form of the new High Value Council Tax Surcharge (HVCTS), popularly dubbed the "mansion tax", a new charge likely to raise around £400m per year.

Calculation and payment

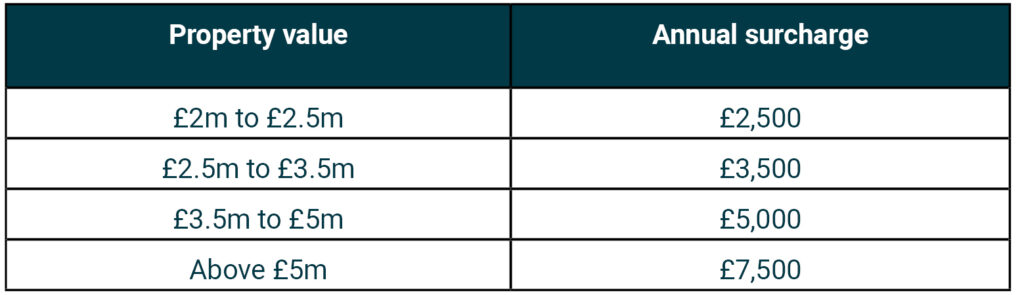

From 1 April 2028, HVCTS will be payable annually by the owners (not occupiers) of residential property in England valued above £2,000,000. Properties will be placed into one of four bands, based on their value, following an initial valuation in 2026, and every 5 years thereafter. The surcharge will increase in line with Consumer Price Index (CPI) inflation each year.

When is a mansion not a mansion?

Whilst it is anticipated that fewer than 1% of properties in England will be above the £2 million threshold liable to pay HVCTS, the reality is that HVCTS will, from the outset, be payable by many owing family homes that fall far short of the popular perception of a “mansion”.

Annual payment

HVCTS will be payable by the owner of the property each year in addition to the existing Council Tax payment. The payment will be collected by the local authority alongside Council Tax, but the surcharge will be directed to central government.

By way of example, from April 2028 the owner of a residential property in Putney, London valued at over £5 million, will be liable to pay Council Tax currently £2,060.35 per annum (Band H) and HVCTS of £7,500 per annum.

Valuation and market impact

The Valuation Office will conduct a “targeted valuation exercise” in 2026 to identify properties above £2 million. It is not yet clear how this will be done, but it could disrupt the pricing of homes coming to market in or around the £2 million valuation point and at the margins of other band levels. We are likely to see that effect on the market now, even though the surcharge itself will only be payable from 2028. Equally, it may prompt some owners such as “empty nesters” to downsize to avoid the new surcharge.

Further consultation

The new charge raises many questions.

- Who will be liable to pay HVCTS where the property is subject to a long lease?

- Will there be exemptions or schemes in place to support those that may struggle to pay the charge?

- Will it be possible for the elderly to defer payment of the charge?

The Government will consult on these points in the New Year. Meanwhile, do please speak to us for further advice on property taxes specific to your circumstances.

Residential property has been the target of many tax changes in recent years. Stamp Duty Land Tax (SDLT) remains complex and expensive, Council Tax valuations are still based on 1991 valuations, and the Additional Tax on Enveloped Dwellings (ATED) imposes significant charges on many companies that own dwellings. Whereas simplification of the current rules might have brought more coherence to land taxation, it is questionable whether a new charging and assessment procedure, in the form of HVCTS, or the “mansion tax” will achieve this.