Largest number of HNW’s relocating to the UK last year came from China

Written by

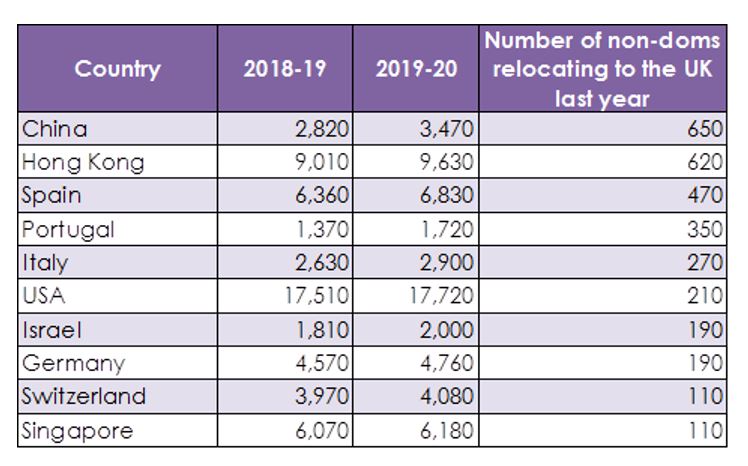

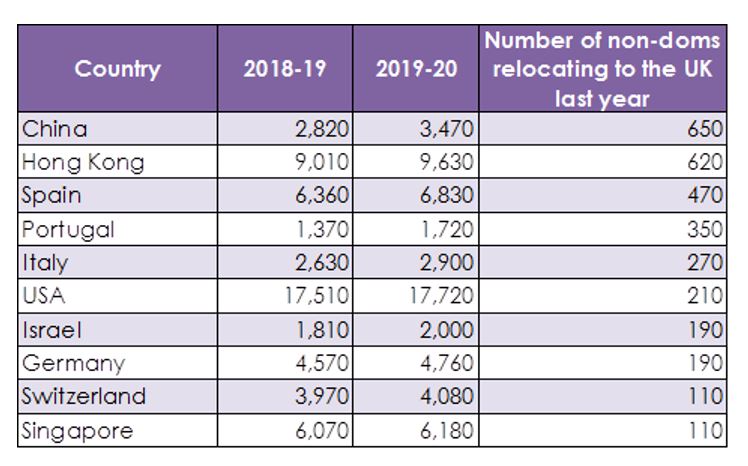

The largest number of High Net Worths (HNWs) relocating to the UK last year came from China, with 650 non-domiciled individuals moving to the UK*, says Boodle Hatfield, a leading private wealth law firm.

HNWs from Hong Kong (SAR) represented the second biggest group of HNWs moving to UK with 620 non-doms relocating to the UK last year. Hong Kong was followed by Spain in third place with 470 HNWs relocating to the UK (see table below).

Chinese HNWs are often drawn to the UK for its high-quality private schools and universities on offer for their children and its investment opportunities. In particular, wealthy Chinese families are attracted to the relative stability and liquidity of the UK residential property market.

Despite Brexit, Chinese investors continue to view the UK as one of the most secure jurisdictions in which to hold assets. This is largely due to its stable political environment, rule of law and track record of protecting investors from state seizures of assets.

Boodle Hatfield says that the existing international make-up of London also acts a magnet to other mobile HNWs. London has also built itself a reputation of being Europe’s leading tech/innovation hub, providing numerous start-ups for HNWs to invest in.

Recent reports have suggested that investments in the UK by Chinese investors have an accumulated value of £135bn. This consists of stakes in infrastructure such as water suppliers and airports, £57bn worth of shares in FTSE100 companies** and property, including private schools.

Kyra Motley, Partner at Boodle Hatfield says: “Despite all the uncertainties created by COVID and Brexit, more wealthy individuals from China are taking the opportunity to make their move to the UK and start a new life for both themselves and their family.”

“Foreign nationals contribute huge amounts to the UK’s tax take whilst providing capital for UK businesses. As a result, these individuals will be instrumental in helping the country get back up on its feet following COVID.”

Significant changes to the UK’s tax regime for non-domiciled individuals came into place in 2017 which means that the tax benefits of being a ‘non-dom’ are now only available for the first 15 tax years that an overseas individual is resident in the UK. This change does not seem to have deterred Chinese HNWs from relocating.

Kyra Motley adds: “Overseas HNWs coming to the UK have been faced with two major obstacles – Brexit and a less favourable tax regime. In spite of this, the UK remains an attractive location to relocate to and expand their wealth.”

Top 10 countries with the biggest contribution of new non-domiciled individuals relocating to the UK

*HMRC, Mainland China only. Year-end April 5 2020

**Argus Vickers, May 2021

This article was first published in The Times on 22nd November 2021.