Value of UK’s biggest serviced office providers’ property portfolio rises to £19bn

Written by

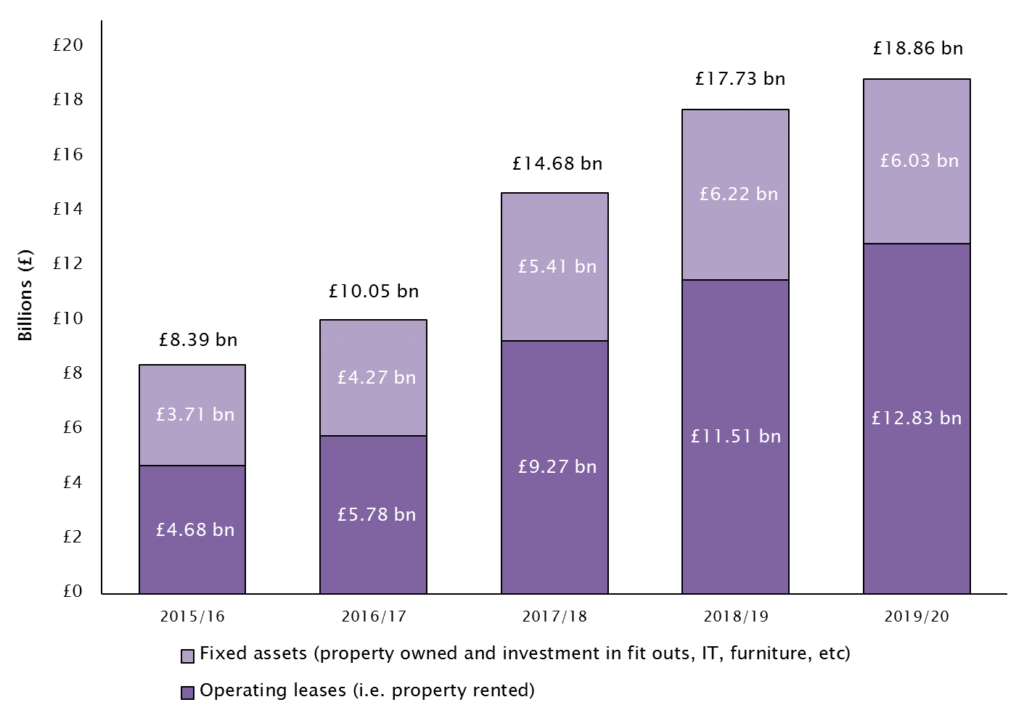

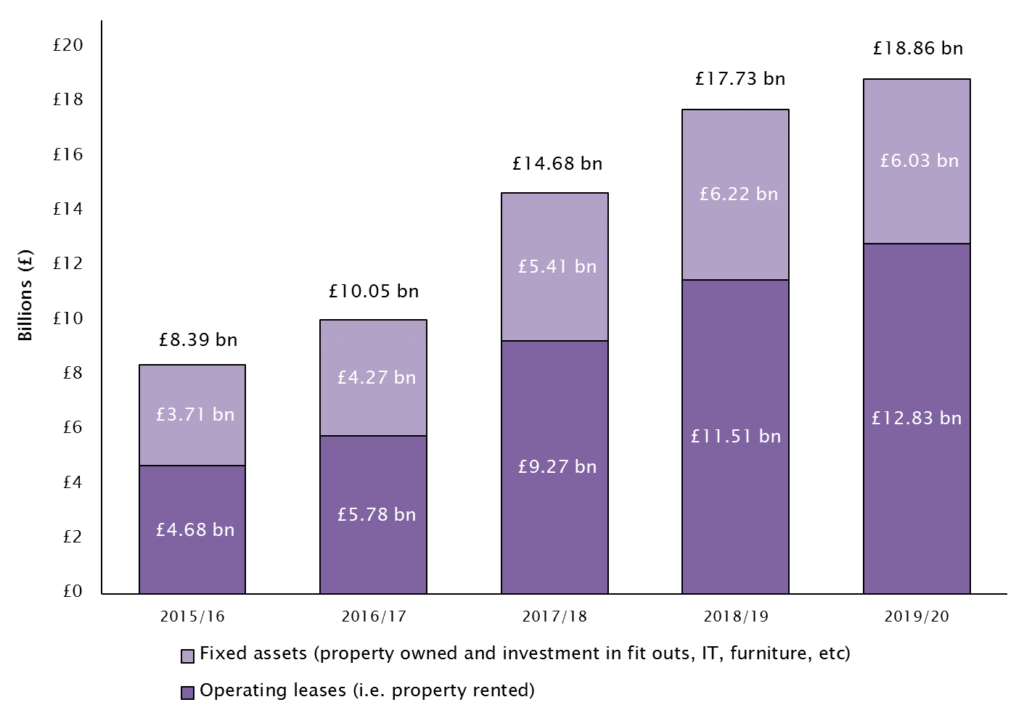

The UK’s biggest serviced office providers grew their property portfolio by 6% to a value of £18.9bn in the last year, up from £17.7bn the year before*, says Boodle Hatfield, the leading private wealth law firm.

The serviced office sector had enjoyed rapid expansion prior to coronavirus, growing 21% between 2019 and 2020. The sector is now facing short-term challenges through the widespread shift to working from home. However, over the medium term the sector is expected to benefit, as more businesses look to use their property portfolios more efficiently, by making increasing use of flexible offices for meetings or project work.

David Rawlence, Associate at Boodle Hatfield, says: “Growth in the serviced offices sector has been on an upward trend in recent years. However, the pandemic will be the real test to see whether this continues once lockdown restrictions ease – the hope is that the sector will be a long-term winner from the pandemic.”

How industry leaders have performed during Covid

Understandably, the shift towards home working during lockdown has seen demand for serviced offices decrease, alongside more traditional office occupancy. The co-working giant, WeWork, recently announced it had experienced a drop in occupancy rates to 47%, down from 72% before the pandemic hit, with some tenants unable to pay rent on time.

In spite of the challenges posed by coronavirus there are some green shoots of recovery for the sector. IWG, the world’s largest serviced office provider recently signed agreements with Cisco, Staples, Standard Chartered and reportedly with the Department for Work and Pensions. It has also secured an agreement with Japanese telecoms group Nippon Telegraph and Telephone, its largest customer to date.

Innovation to boost occupancy rates within the sector

There has been increasing innovation within the serviced office sector to keep offices occupied all year-round. This includes a shift away from fixed rents and the conventional leasing model, towards revenue sharing leases and agreements. As well as, increasing cooperation between the property owners and the operators of flexible offices in respect of fitting-out and marketing the properties.

WeWork has already made use of these agreements in its acquisition of the Devonshire Square office complex in the City of London, in which it negotiated revenue sharing leases with its landlords, TH Real Estate and Danish pension fund PFA Ejendomme.

Revenue shared agreements tend to offer more flexibility for serviced office operators and incentivize the operator to increase occupancy rates and revenues. However, these agreements have the potential of creating a volatile income stream for landlords as they are largely dependent on the income actually received from the occupiers of flexible offices.

In order to make up for losses during lockdown and further attract tenants, there are reports that WeWork is launching a monthly membership which offers tenants an “all access” pass to all of its locations, as well as, incorporating gyms and coffee shops. In addition, WeWork has also set aside £15m to subsidise rents for its struggling SME tenants to relieve the financial strain they have faced as a result of the pandemic.

David Rawlence adds “With organisations looking to use their property portfolio more efficiently, serviced office providers are working hard to increase their appeal and improve their offerings, in the hope of attracting new tenants once workers return to the office.”

“The serviced offices sector is continually innovating, particularly through movement away from the traditional leasing model, towards revenue shared agreements. There seems to be a general trend of greater collaboration between property owners and operators to establish creative models with sustainable, yet attractive offerings.”

Value of UK’s biggest serviced office providers’ property portfolio increased to £18.9bn last year

*Based on Top 12 serviced office providers – accounts filed as of 9 March 2021. Under IFRS 16, a new International Financial Reporting Standard, that changes the accounting rules on property leases, the value of the UK’s biggest serviced office providers’ property portfolio increased to £28bn in the last year. However, in order to allow a comparison with previous year’s data pre-IFRS 16 numbers are used.

This article was first published in CityAM and Propertywire on Monday 19th April 2021.