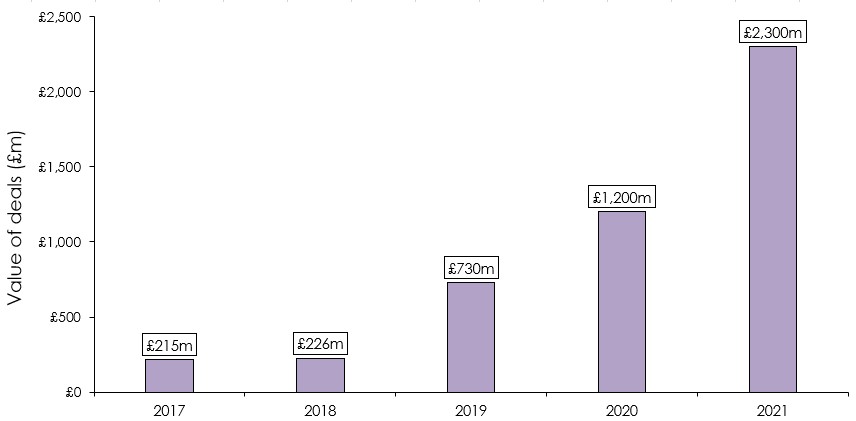

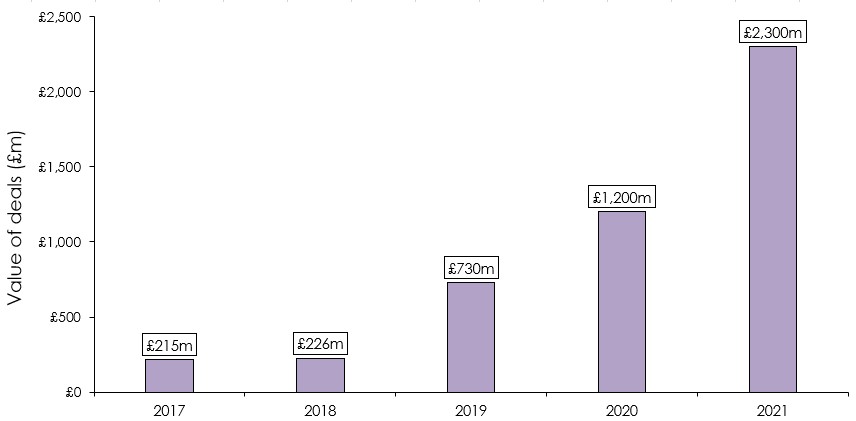

Value of UK PE deals by HNWs doubles in past year to reach £2.3bn – the highest in a decade

Written by

The value of UK private equity deals* undertaken by High-Net Worth individuals (HNWs) has hit the highest level in a decade, almost doubling to £2.3bn last year, up from £1.2bn in 2020, says Boodle Hatfield, a leading private wealth law firm.

Boodle Hatfield says wealthy individuals are choosing to lead individual private equity deals partly to access the asset classes’ returns without having to pay the management fees and ‘carry’ associated with investing through a private equity fund.

Private equity has consistently outperformed the public markets with returns of 13.9% per annum (on assets expected to be held for 10 years or more) compared to 5.6% per annum for the FTSE All Share Index**.

Low interest rates have also made it easier for HNWs to fund PE deals. The low cost of borrowing means that they build up the debt element of the PE deal quickly and for a lower cost, making it easier to execute a deal.

Boodle Hatfield says acquiring a controlling stake in a business and helping it grow is an attractive prospect to the many HNWs whose wealth has come through the building of their own business.

Kyra Motley, Partner at Boodle Hatfield, says “An increasing percentage of the UK’s HNW investors are from an entrepreneurial background. For them leading a PE deal doesn’t seem that much of a stretch from leading their own company.”

“The opportunity for high returns from these deals continues to attract the ultra-wealthy to private equity but they are motivated by more than just the returns. They genuinely love to see businesses grow.”

“If interest rates remain relatively low we expect to see appetite for private equity deals to continue to be high.”

Among the private equity deals undertaken by HNWs this year are purchases of football clubs, Hull City and Wigan as well as rugby club, Saracens. Trophy assets such as sports teams have typically attracted investment due to their prestige.

The largest deal of 2021, by some margin, is the £2.2bn acquisition of a London-based kids entertainment company by two former Disney executives.

The technology sector made up 25% of all deals in the past year, comprising six of the 24 deals.

Boodle Hatfield says that the accelerated growth of many tech companies during the pandemic is likely to have made them more attractive investment prospects.

Kyra Motley explains: “Innovation in technology software and automation tools during the pandemic has seen deal activity within the sector go through the roof. It’s little surprise that HNW investors are keen to participate in deals in this sector.”

Value of UK private equity deals undertaken by HNWs

*Led or jointly led, year end Dec 31

**British Private Equity and Venture Capital Association

Quotes from this article were included in CityAM, Private Equity International, PE News and The Scotsman.