The taxation of UK residential property: What has changed today?

Written by

Earlier today, the recently appointed Chancellor, Kwasi Kwarteng announced changes to the stamp duty land tax ('SDLT') payable in England and Wales on residential property as part of his statement on the governments new Growth Plan.

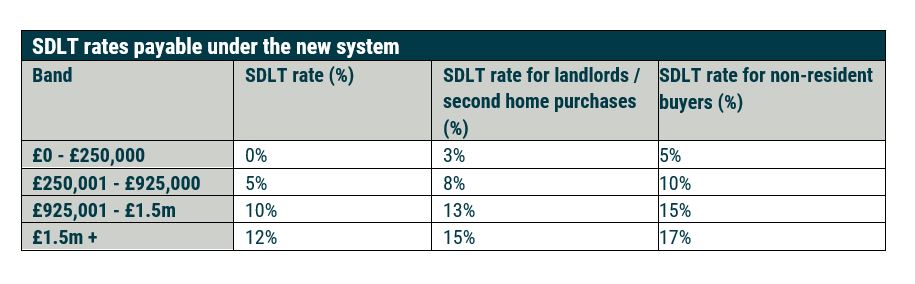

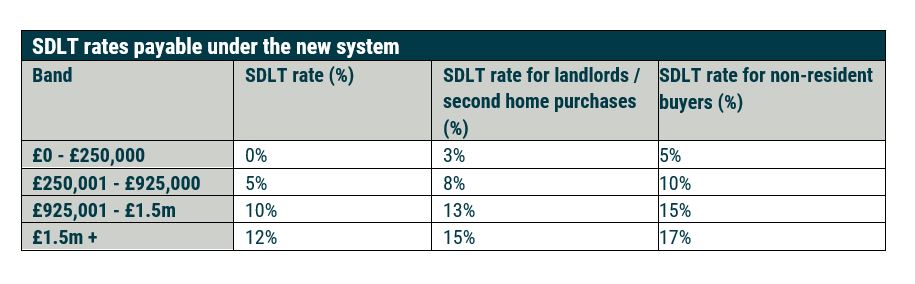

We have of course seen dramatic changes to the taxation of UK residential property over recent years and this new approach leads to a saving for buyers. The table below details the SDLT rates payable under the new system. These threshold changes are effective from today (23 September 2022).

These rates apply to transactions completing on or after today. We anticipate this will include transactions completing under contracts exchanged before 23 September 2022. Once the draft legislation is available we will issue an update if our view changes.

There are also changes announced to the SDLT first time buyers relief. Firstly the threshold at which qualifying buyers start paying duty has increased from £300,000 to £425,000 and secondly the eligible property value has increased to less than £625,000.

This summary is intended to provide a first point of reference for current developments in aspects of the law. It should not be relied on as a substitute for professional advice.