Part Two: The Rat Race – on the final straight?

Written by

PropTech is the technology that enables the Hub & Spoke Model; Flex Space; and Desks for Hire. It facilitates the better use and management of property.

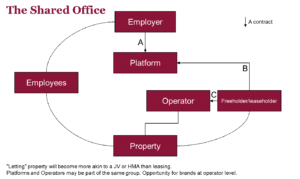

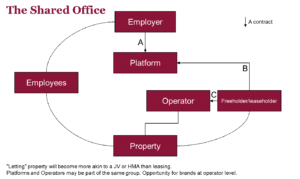

Instead of the linear process where landlords directly market their spaces to occupiers and negotiate complex lease structures, technology platforms will enable space owners (the supply) to connect to potential occupiers (the demand) easily and frictionlessly.

We may begin to see the terms under which a company or its employees access space being governed not by a formal lease but by sets of general terms and conditions.

Whilst an organisation letting out one desk a week will likely be able to use its existing resources to list that desk on the platform and manage the arrival and departure of its end user; organisations who let out entire office floors, are unlikely to want to dedicate the resources to managing this process. As such, space owners are likely to engage a property manager to manage this for them. Organisations such as Nestify have sprung up in the residential world to manage Airbnb rentals for home owners. We envisage a similar network of support businesses growing out of a commercial Airbnb style platform; these will run the building and the services therein. Much like a hotel management agreement.

Potential benefits

The benefits to employers and employees are clear.

At first glance, landlords and space owners may raise eyebrows. We agree, this structure may not be for everyone. However, consider a landlord letting space to a serviced office company. At present the serviced office company takes a headlease which is then sublet out to others. You are reliant on one entity (putting aside any guarantors) for your rental income. If they are unable to let space, then they are unable to pay rent.

Listing space on a platform diversifies the use of your space and de-risks your position. Like investing in a fund, as opposed to one company’s shares. The advantage to the subscription model is that the same space can be taken twice – two companies may be on contracts which give their employees the right to access a particular number of seats but then of course, it’s not guaranteed that all their employees will need access at the same time. In the same way that airlines oversell seats, you oversell space; there are of course some careful calculations to be done here! The point is that in the same way property investors use debt to leverage their potential gains, technology can be used to leverage a real estate asset.

Back to the rat race?

The rat race in its truest sense will continue – there is always a greasy pole to climb – but will we all return to the daily commute to one central location? Probably not. As employers begin to understand what employees would like with respect to office space, they will begin to make commercial decisions about their space needs. This presents a great opportunity for landlords, PropTech companies, investors and those seeking to enter JV partnerships in equal measure.

To read part one of the article, please click here.