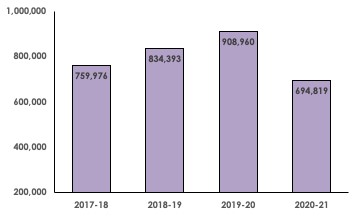

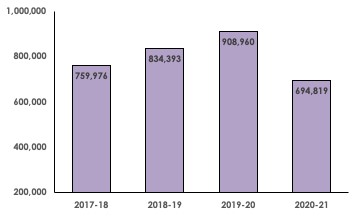

LPA registrations dropped 23% in past year

Written by

The number of Lasting Powers of Attorney registered dropped 23% in the past year from 909,000 in 2019/20 to 695,000 in 2020/21*, says Boodle Hatfield, the leading private wealth law firm.

Boodle Hatfield says failure to make a Lasting Power of Attorney (LPA) could create enormous problems in the event of that person suddenly becoming incapacitated.

LPAs allow individuals to pass on the legal responsibility for making financial decisions on their behalf, in case of loss of mental capacity.

If no LPA is in place, an application would have to be made for an emergency deputyship. However, the incapacitated person would have no say as to who is appointed to manage their affairs, nor the scope of their powers.

The process of appointing a deputy (as opposed to putting in place an LPA) can be complex and expensive. Should the application be refused, the local council could be appointed as deputy.

The drop in registrations of LPAs is likely to be due to disruption caused by social distancing and shielding during lockdown, with many people forced to wait until restrictions ease before progressing their applications. Boodle Hatfield says this has been a particular issue for older people who are at the highest risk of becoming incapacitated and therefore, most in need of an LPA.

LPA applications must be signed in the correct order by several people. Applicants may not make copies of the document and digital signatures are not permitted. The signatures must be witnessed in person, rather than over Zoom.

Boodle Hatfield says that the drop in registrations is one of the unanticipated problems created by the pandemic that will need to be urgently resolved.

Geoffrey Todd, Partner at Boodle Hatfield says: “Now that restrictions have eased, anyone who had been putting off making an LPA should begin the process as soon as possible.”

Lasting Powers of Attorney give appointed individuals the power to manage another’s finances, including looking after their bank accounts and paying bills in the event that they no longer are able to make such decisions for themselves. LPAs can cover temporary periods of incapacity such as a serious illness or injury in an accident, as well as longer lasting conditions such as dementia.

Geoffrey Todd adds: “The sharp drop in the number of LPAs being registered is alarming and could create unnecessary problems down the line.”

“The pandemic has shown that it’s not just older people who become incapacitated. Sadly, many younger, previously healthy people who have contracted Covid have experienced sudden, debilitating illness.”

“It’s crucial to take action to safeguard your finances in the unfortunate event that you lose capacity. Failure to do so can create significant difficulties for families during what is already a stressful time.”

“Having an LPA in place provides a safety net should the worst happen.”

Number of LPAs received reach four-year low during pandemic

Comments from this article were first published by the FT Advisor on 13th August 2021.