Decisions, decisions

Written by

In the same way that there are infinite ways in which a property can be managed, occupied and its expenses and revenues split, there are infinite ways in which the legal documents can be drafted to accommodate the needs of the respective parties.

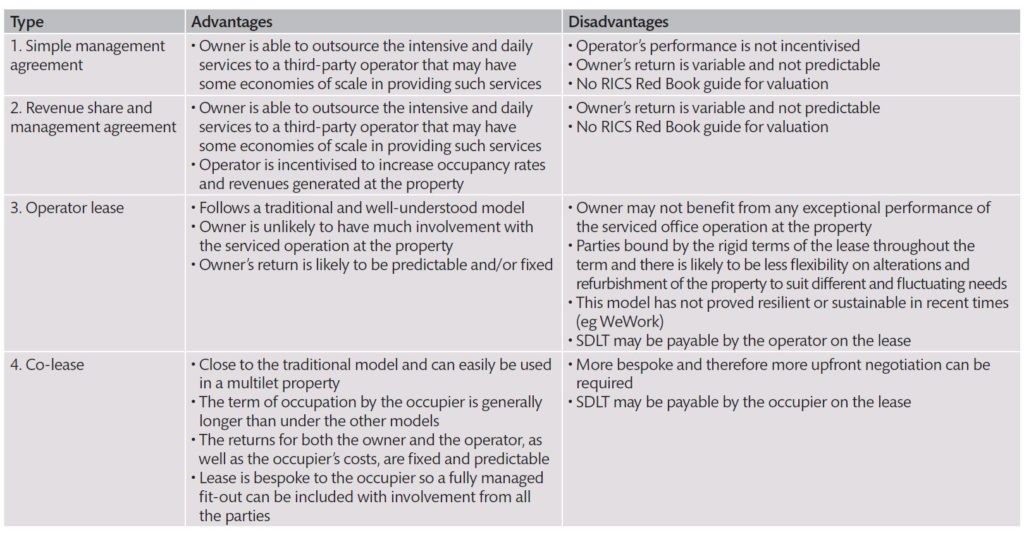

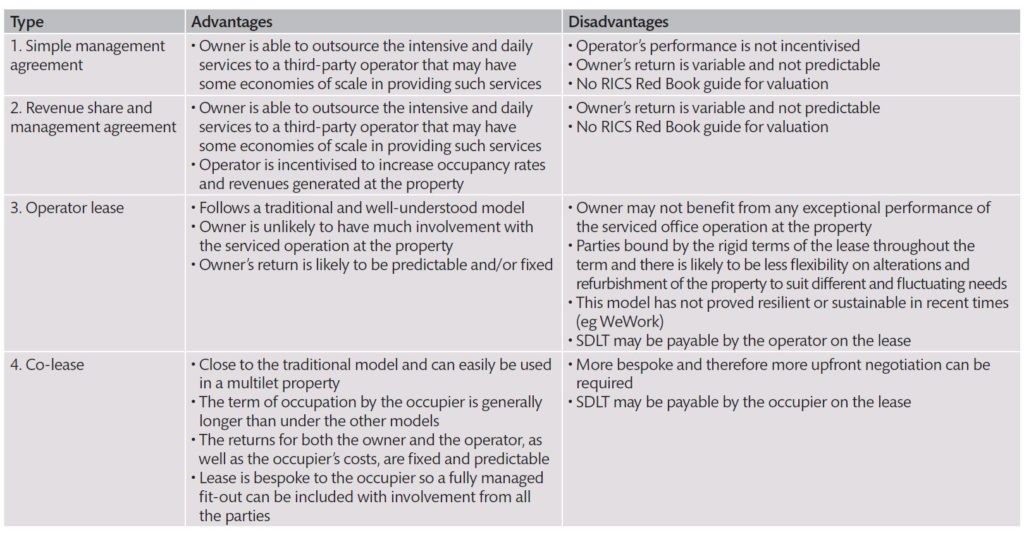

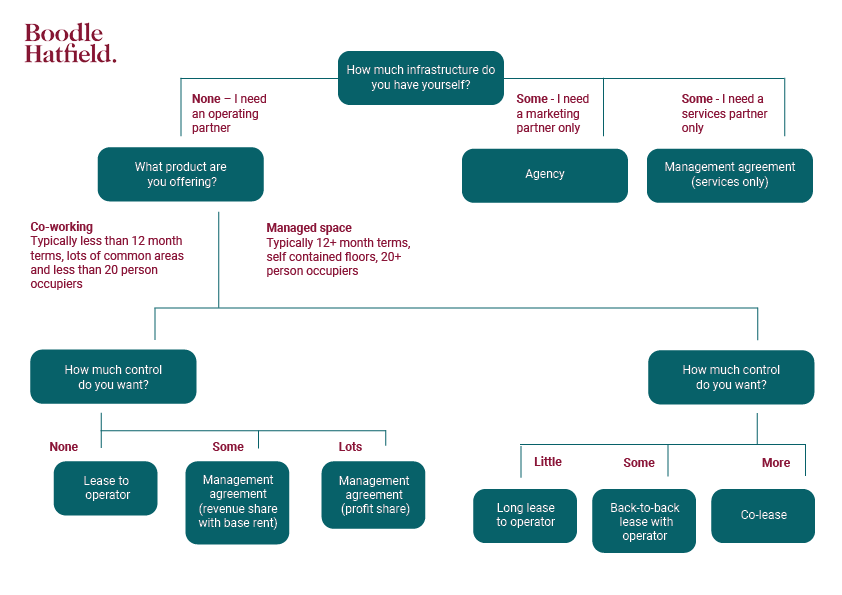

However, Boodle Hatfield, a law firm, and Kitt Offices, a serviced office operator, have found that the following structures are the four most common in the serviced office market where operators are involved (rather than the owner managing in-house).

This article sets out to both outline the nature of these structures as well as the respective advantages and disadvantages of such arrangements for property owners.

Simple management agreement

This is a collaborative approach whereby the owner and the operator agree to divide the responsibilities at the property. Typically, with a serviced office product, the operator is required to provide intensive and daily services to the occupiers of the property (such as provision of cleaning, food and beverage, front of house staff etc.) as well as the marketing of the property and the procurement of occupiers. The owner usually retains obligations to maintain the property. The payment for the operator’s services under this mode is either fixed or directly correlates to the operator’s expenditure. With this model there is no correlation to the revenues generated by the service office operation at the property.

Management agreement with a revenue share

This arrangement will likely include a similar split of obligations as set out approach (1) but with a revenue share arrangement agreed between the owner and operator dependent on the performance of the serviced office.

This revenue share can be ‘sliced and diced’ as required between the parties. However, it is likely that some form of preferential share will be payable to the owner via an agreed waterfall on payments.

The occupational interest granted to the occupier is either granted by the owner (but the on-boarding process managed by the operator) or by the operator as agent for the owner.

If this agreement is longer than a few years then it may be prudent for the parties to agree provisions concerning any capital expenditure required to ensure that both the property remains fit for purpose as a serviced office operation and that the revenue generated at the property is maintained throughout the term of the agreement.

In relation to management agreements (models 1 and 2), g8 consult, a specialist flexible workspace agency, highlights the mutual benefits of these arrangements: ‘For operators, they can allow faster growth without having to take on significant financial commitments. For property owners, they outsource the operational skills needed to generate income and market flexible workspace effectively and professionally.’

Lease directly to operator

This structure follows the traditional leasing model whereby the operator takes a lease of the property and pays a fixed rent or turnover-based rent to the property owner. The operator will then grant occupational interests to the occupiers, usually licences or short-term leases. The responsibilities for managing and maintaining the property will usually follow the traditional leasing models.

For this model, the owner of the property has no contractual relationship with the occupiers of the property and very little or no involvement in the day-to-day running of the serviced office operation at the property.

The frailties of this model, with a fixed rent, were widely documented when WeWork aborted its IPO in 2019 amid accusations that its business model was unsustainable and vulnerable to a market downturn. And with the current reduced office occupancy rates due to COVID-19 this model is likely to become even more unpopular for operators.

Where a turnover-based rent is agreed between the parties, as with model 2 above, the share of the revenue generated from the occupiers again can be ‘sliced and diced’ as required. As the rent payable to the owner is linked to the revenue generated by the operator and the occupational interests tend to be quite short-term, this model is almost immediately adversely affected by market downturns (such as COVID). This is because occupiers are less likely to want new space or renew their current space during a market downturn so the occupancy rate will quickly track the wider market. However, as no fixed rent is payable by an operator (or if a base rent is payable, it is usually well below market rent) the insolvency of an operator is less likely.

Co-lease

This is an approach pioneered by Boodle Hatfield and Kitt and has also been termed a ‘managed space product’.

This is a lease entered into by three parties; the owner, operator and occupier. The co-lease sets out the separate services provided by the owner and the occupier for the benefit of the occupier as well as the orthodox lease terms. As with most service office occupier agreements, the rent under the co-lease is ‘all-inclusive’ so that the occupier only pays one fee for its occupation with insurance, service charge, rates etc. included.

The split of property management obligations and the share of the gross revenue derived from occupier is dealt with via a simple property management agreement between the owner and the operator (which is confidential to the occupier).

As this is a form of lease, the terms are generally longer than licence agreement – at between 2-4 years. Given this and the fixed rent payable, the co-lease model will likely prove resilient during market-downturns.

However, as the co-lease is a tri-partite agreement it can be more complicated to negotiate than an operator’s standard form licence or traditional lease.

Final word

In the absence of a crystal ball, it is not possible to designate any model as ‘the best’ for both landlord returns and mitigation of the landlord’s risk. Having said that, the general trend is for increasing collaboration between owners and operators to find creative models that ensure sustainable and resilient serviced office products.

David Rawlence is an Associate at Boodle Hatfield and Steve Coulson is CEO and co-founder of Kitt Offices.

This article first appeared in Estates Gazette on 18th March 2021.

Serviced Office Decision Tree

Which structure to choose?